- News

- Business News

- India Business News

- IDFC looks to exit asset mgmt biz in Rs 4,000cr deal

Trending

This story is from March 22, 2018

IDFC looks to exit asset mgmt biz in Rs 4,000cr deal

Boby Kurian, Mayur Shetty & Partha Sinha | TNN

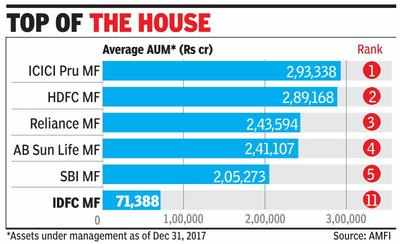

Mumbai: IDFC has begun discussions with IndusInd Bank and Citic CLSA, among others, to merge or sell its asset management company (AMC) — which manages about $11 billion, or Rs 71,000 crore — as part of value-unlocking moves for shareholders, multiple sources familiar with the matter said.

The Hong Kong-based financial services behemoth Citic CLSA and buyout private equity firms like Apax Partners too have evinced early interest to pursue a deal-making.IDFC is expected to ask for a Rs 4,000-crore payout — almost 6% of the assets under management — as the deal valuation. A fourth of the AMC’s assets under management are equity, while the rest are in debt. These exploratory talks would gain momentum only after IDFC allows potential bidders to conduct due diligence, sources added.

A senior official recently told this newspaper that IDFC could explore value-unlocking moves for the AMC business. “This could be either through a merger or a partnership deal,” he had said without divulging details. IDFC, which controls IDFC Bank through a non-operating financial holding company, has a beaten down market value of Rs 7,900 crore, or $1.2 billion.

IDFC is in the midst of a merger process with Capital First, a non-banking finance company. In January, the private bank agreed to acquire Capital First in a share-swap deal valued at about $1.5 billion as part of efforts to boost retail loans.

IndusInd, originally promoted by the

Average assets under management (AAUM) of the Indian mutual fund industry stood at over Rs 23 lakh crore in February this year. Domestic mutual funds have reported a fourfold rise from just Rs 5 lakh crore a decade ago. IDFC Asset Management Company was established in the year 2008 after IDFC bought StanChart Asset Management for Rs 820 crore (paying 5.6% of the value of assets under management). StanChart had got the mutual fund subsidiary as part of its deal to acquire ANZ Grindlay’s Bank in 2000.

The value-unlocking moves should also be seen in the context of some IDFC shareholders being unhappy with the lackadaisical share price, which they believe is trading at more than 50% discount to its intrinsic fair value. The stock closed at Rs 50 apiece in Mumbai trade on Wednesday.

Mumbai: IDFC has begun discussions with IndusInd Bank and Citic CLSA, among others, to merge or sell its asset management company (AMC) — which manages about $11 billion, or Rs 71,000 crore — as part of value-unlocking moves for shareholders, multiple sources familiar with the matter said.

The Hong Kong-based financial services behemoth Citic CLSA and buyout private equity firms like Apax Partners too have evinced early interest to pursue a deal-making.IDFC is expected to ask for a Rs 4,000-crore payout — almost 6% of the assets under management — as the deal valuation. A fourth of the AMC’s assets under management are equity, while the rest are in debt. These exploratory talks would gain momentum only after IDFC allows potential bidders to conduct due diligence, sources added.

A senior official recently told this newspaper that IDFC could explore value-unlocking moves for the AMC business. “This could be either through a merger or a partnership deal,” he had said without divulging details. IDFC, which controls IDFC Bank through a non-operating financial holding company, has a beaten down market value of Rs 7,900 crore, or $1.2 billion.

When contacted, an IDFC spokesperson said the company would not comment on speculative queries. IndusInd said that it “denies this market speculation”.

IDFC is in the midst of a merger process with Capital First, a non-banking finance company. In January, the private bank agreed to acquire Capital First in a share-swap deal valued at about $1.5 billion as part of efforts to boost retail loans.

IndusInd, originally promoted by the

Hindujas and the first private bank to get a licence in post-liberalised India, is on the lookout to build a full suite of financial services. “Asset management is an ROE (return on equity) business they are interested in at a reasonable valuation,” one of the sources cited earlier said. CLSA has been interested in India’s expanding asset management industry with low penetration and expected to benefit from an increasingly digital economy.

Average assets under management (AAUM) of the Indian mutual fund industry stood at over Rs 23 lakh crore in February this year. Domestic mutual funds have reported a fourfold rise from just Rs 5 lakh crore a decade ago. IDFC Asset Management Company was established in the year 2008 after IDFC bought StanChart Asset Management for Rs 820 crore (paying 5.6% of the value of assets under management). StanChart had got the mutual fund subsidiary as part of its deal to acquire ANZ Grindlay’s Bank in 2000.

The value-unlocking moves should also be seen in the context of some IDFC shareholders being unhappy with the lackadaisical share price, which they believe is trading at more than 50% discount to its intrinsic fair value. The stock closed at Rs 50 apiece in Mumbai trade on Wednesday.

End of Article

FOLLOW US ON SOCIAL MEDIA