DXY slumps & havens lifted after China raises tariffs on US goods to 125% - Newsquawk US Market Open

- China unveils additional tariff measures on US goods; to raise additional tariffs on US goods to 125% from 84%. Effective April 12th.

- China’s Finance Ministry says “if the US continues to impose additional tariffs on Chinese goods exported to the US, China will ignore it”.

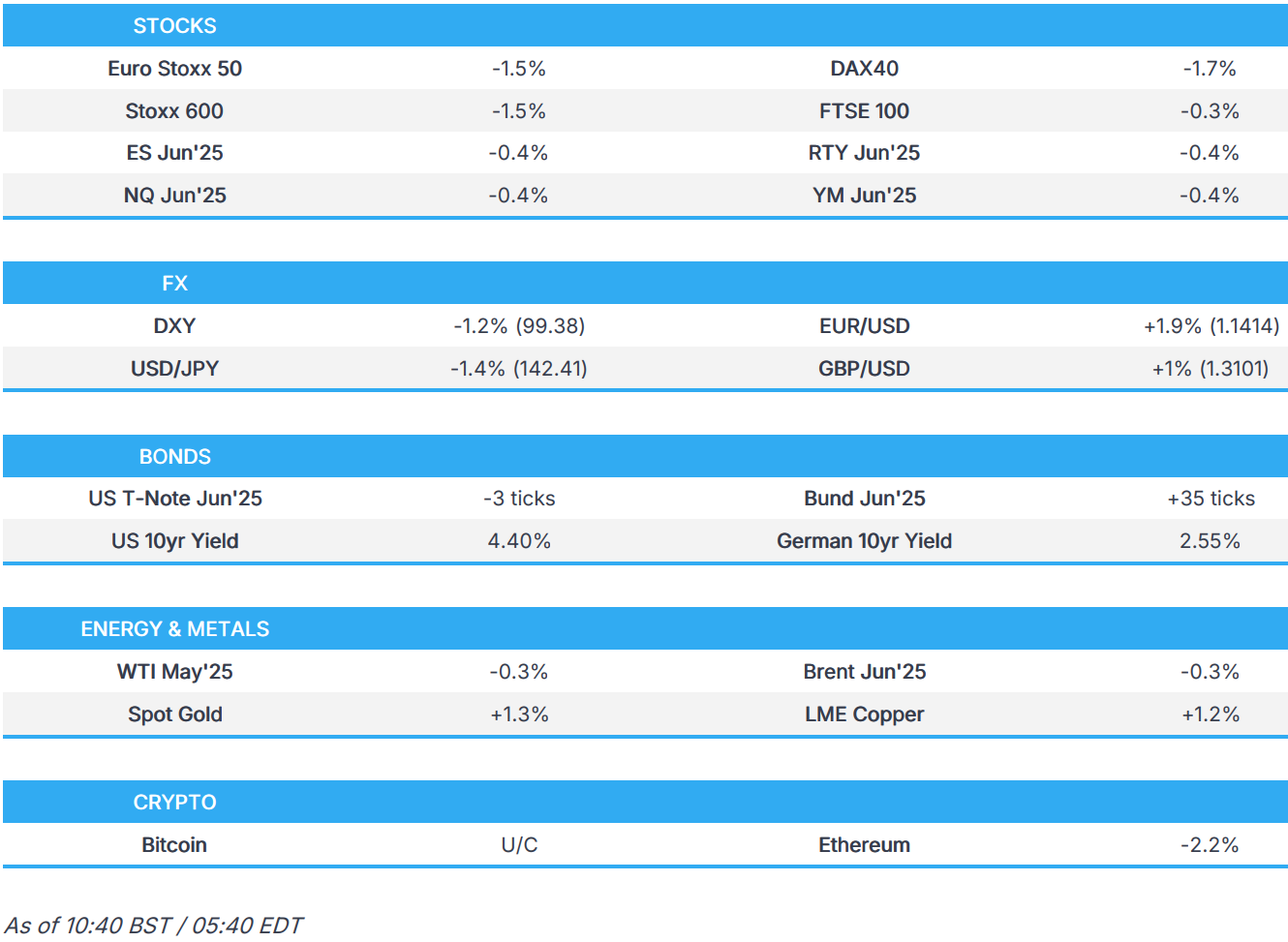

- European indices hit after China raises tariffs; US futures modestly lower into bank earnings.

- DXY slumps to a 99.01 low after China increases tariffs on the US; EUR outperforms.

- Bonds lifted by China's latest retaliation but remain on track to end the week with significant losses.

- Base metals underpinned by hopes of Chinese stimulus.

- Looking ahead, US PPI, UoM Prelim, Moody’s review on France, UK, Italy, Spain & Switzerland's Credit Rating, Speakers include Fed’s Musalem, Williams & BoE’s Greene. Earnings from JPMorgan, BlackRock, Wells Fargo, Bank of New York Mellon, Morgan Stanley & Fastenal.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 day

TARIFFS/TRADE

Apr 11th: China raises tariffs on the US to 125% from 84%

- China unveils additional tariff measures on US goods; to raise additional tariffs on US goods to 125% from 84%. Effective April 12th. Finance Ministry "if the US continues to impose additional tariffs on Chinese goods exported to the US, China will ignore it". “Given that there is no longer any possibility of market acceptance for US goods exported to China under the current tariff levels, if the US side subsequently continues to impose tariffs on Chinese goods exported to the US, the Chinese side will pay no attention to it,”. If the US insists on infringing on China's interests in a substantive way, China will resolutely take countermeasures.

- China's Commerce Ministry says the US' repeated imposition of abnormally high tariffs on China has become a "numbers game" and has no practical economic significance.

- Global Times Editor Hu Xijin tweets "With tariffs already so high on both sides, to be honest, we no longer see it as anything extraordinary."

Other

- US President Trump posted on Truth Social that "Mexico owes Texas 1.3mln acre-feet of water under the 1944 Water Treaty, but Mexico is unfortunately violating their Treaty obligation," while he threatened "escalating consequences, including TARIFFS and, maybe even SANCTIONS, until Mexico honours the Treaty, and GIVES TEXAS THE WATER THEY ARE OWED!".

- Mexican President Sheinbaum stated that Mexico sent a proposal to the US to address water deliveries to Texas and she has instructed her administration to contact US officials and is sure an agreement will be reached, while she noted Mexico has been complying with the treaty as water availability allows, amid three years of drought.

- White House trade advisor Navarro said they are going to get deals from Australia, India, and the UK, and that those three are all coming in.

- EU Commission President von der Leyen said could tax big tech if Trump trade talks fail, while she added the EU would seek a "completely balanced" agreement with the US during Trump's 90-day pause in applying additional tariffs and there is a wide range of countermeasures in case the negotiations are not satisfactory, according to FT.

- Vietnam plans to crack down on illicit transhipment of goods from China to the US amid Trump tariff risks.

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX 600 -0.9%) opened entirely in the green, attempting to build on the prior day’s gains. However, indices rapidly turned negative after China announced additional tariffs on US goods, taking the total to 125% from 84%; these will come into effect on April 12th.

- European sectors opened almost entirely in the green, but the picture quickly turned negative after the aforementioned Chinese tariff announcement. There is now a clear defensive bias in Europe; Utilities leads, alongside Healthcare. The typical cyclical sectors find themselves towards the foot of the pile; Travel & Leisure, Autos and Basic Resources are all lower.

- US equity futures (ES -0.4%, NQ -0.4%, RTY -0.4%) are lower across, with sentiment hit after, China, once again, announced retaliatory tariffs on the US – taking the total tariffs on US goods to 125%.

- Elsewhere, we await the formal start of US earnings season with numerous major banking names due to report.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- Another downbeat session for the Dollar following Thursday's detrimental losses which saw the index slip from a 102.95 peak to a 100.69 trough on Thursday, before extending downside to a 99.71 low in APAC hours - falling beneath 100 for the first time since July 2023. The index then took another dive lower after China raised its tariffs on the US to 125% from 84% in a retaliatory move. DXY has dived to an intraday 99.01 low from a 100.63 intraday high at the time of writing.

- EUR has been bolstered by the collapse of the Dollar coupled with its status as a liquid reserve currency, and the market belief that the EU will not escalate the US trade war - with US tariffs on the EU trimmed to 10% from 20% whilst the EU also paused its tariffs in tandem. Further upside is seen after China raised its tariffs on the US to 125% from 84% in a retaliatory move, which took EUR/USD to north of 1.1400.

- JPY is benefitting from the softer Dollar and ongoing tit-for-tat tariffs between the world's two largest economies. JPY was further bolstered by China raising its tariffs on the US to 125% from 84% in a retaliatory move. USD/JPY resides towards the bottom of a 142.08-144.60 range, with participants looking for further trade updates for impetus.

- GBP is lifted by the softer Dollar, the UK's favourable relationship with the US, and above-forecast GDP metrics. UK GDP printed firmer across the board, albeit the data is for February and is thus stale given the US tariffs.

- Mixed trade across the antipodeans with the Aussie hampered by the fallout of US tariffs on the Chinese economy and in turn demand for Australian natural resources, whilst the Kiwi benefits via the AUD/NZD cross.

- PBoC set USD/CNY mid-point at 7.2087 vs exp. 7.3104 (Prev. 7.2092).

- SNB spokesperson declined to comment when question on the CHF's strength and if any steps are planned.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- A softer start to the day but one that leaves USTs just off the overnight 110-01+ trough, a low which printed as the benchmark faded initial strength on Thursday despite a strong 30yr tap. Action occurred as the risk tone stateside began to lift and as the yield curve steepened further. Only a modest uptick in USTs to the latest additional Chinese tariffs, keeping them within the existing 110-01+ to 110-15 band.

- Bunds began softer and printed a 129.92 low, however the benchmark was holding onto most of the upside that emerged in the latter half of Thursday's session. Unreactive to the final German CPI but was lifted into the green and to a 130.70 peak by China retaliating to the US tariffs - this upside has since continued to a fresh 130.75 peak.

- Gilts opened lower by a handful of ticks at 91.62 before slumping to a 90.78 trough as it reacted to the strong GDP data (though, this will likely be looked through), overnight bearishness in peers and in a pull back from the marked strength seen on Thursday. For the week as a whole, Gilts are set to end it with losses of around 300 ticks but are over 100 ticks above the 89.99 trough.

- UK DMO to sell GBP 1.5bln of 0.125% 2028 Gilt via tender on April 16th.

- Italy sells EUR vs exp. EUR 7.25-9.0bln 2.65% 2028, 3.15% 2031, 0.95% 2032 & 3.25% 2038

- Click for a detailed summary

COMMODITIES

- Crude is lower, in what has been a choppy session thus far. The complex was initially firmer in early European trade, but rapidly turned negative after China raised additional tariffs on US goods to 125% from 84%. Brent Jun'25 currently trading at the lower end of a USD 62.77-64.37/bbl range.

- Firmer trade across precious metals with the complex bolstered by the demise of the Dollar coupled by flight to quality amid the latest chapter in the trade saga. Spot gold topped USD 3,200/oz for the first time overnight and continues grinding higher at the time of writing, currently in a USD 3,177.26-3,227.45/oz intraday range.

- Modest gains across base metals space amid ongoing hopes of Chinese economic support in the face of US tariffs. 3M LME copper trades on either side of USD 9,000/t and resides in a USD 8,934.65-9,170.80/t range.

- Commerzbank reduces year-end price forecast for Platinum to USD 1000/oz (prev. forecast USD 1100/oz) Lowers year-end palladium forecast to USD 1000/oz (prev. forecast USD 1150/oz) Revises gold price forecast upwards to USD 3000/oz (prev. forecast 2850/oz).

- Shanghai Weekly Copper Warehouse stocks -42.7k/T (prev. -9.5k/T W/W)

- Click for a detailed summary

NOTABLE DATA RECAP

- UK GDP Estimate MM (Feb) 0.5% vs. Exp. 0.1% (Prev. -0.1%); 3M/3M (Feb) 0.6% vs. Exp. 0.4% (Prev. 0.2%)

- UK GDP Estimate YY (Feb) 1.4% vs. Exp. 0.9% (Prev. 1.0%)

- UK Services YY (Feb) 1.6% vs. Exp. 1.3% (Prev. 1.4%); Services MM (Feb) 0.3% vs. Exp. 0.1% (Prev. 0.1%)

NOTABLE EUROPEAN HEADLINES

- Germany to provide EUR 11bln in military funding support for Ukraine until 2029, according to Ukrainian Defence Minister.

NOTABLE US HEADLINES

- Fed's Collins (2025 voter) said rate policy is well positioned and holding steady for now seems best, while she added they may yet find space to lower rates this year and that tighter financial conditions may restrain activity. Collins said that policy is still positioned to lower inflation pressures and she sees upside inflation risks and downside growth risk, as well as noted that monetary policy needs to be nimble in an uncertain environment.

GEOPOLITICS

- US aggression targeted several areas in Yemen's capital with a series of raids, according to Al Jazeera.

- Iran Foreign Ministry spokesperson says Tehran is giving talks with the US a genuine chance and intends to assess the other side's intent and resolve this Saturday.

- Iran wants to explore an interim nuclear deal in talks with the US before pursuing negotiations over a comprehensive deal, according to a European diplomat and a source cited by Axios.

- "US sources: The likelihood that Iran will make a decision to build nuclear weapons has increased due to the ongoing military conflicts in the Middle East", according to Sky News Arabia.

- British troops could be deployed in Ukraine for five years under plans being discussed by allies, according to The Telegraph.

- Trump envoy Witkoff to travel to Russia to meet with Russian President Putin, according to Axios; If no ceasefire is reached by the end of the month, Trump could move forward with additional sanctions on Russia.

CRYPTO

- Bitcoin is essentially flat and trades around USD 81.5k whilst Ethereum is a little lower and sits just above USD 1.5k.

APAC TRADE

- APAC stocks mostly followed suit to the declines on Wall St where the major indices gave back a chunk of their historic gains as tariff uncertainty lingered and with the US clarifying China tariffs were at 145%, not 125%.

- ASX 200 was pressured amid underperformance in energy, healthcare and tech, while gold miners outperformed after prices of the precious metal extended to fresh record highs.

- Nikkei 225 briefly fell beneath the 33,000 level with exporters hit by a firmer yen and global trade uncertainty.

- Hang Seng and Shanghai Comp initially conformed to the downbeat mood after the US clarified its tariff on China was at 145% although Chinese markets gradually recouped losses amid hopes of the PBoC to step in with monetary policy support.

NOTABLE ASIA-PAC HEADLINES

- PBoC will implement a moderately loose monetary policy, support the smooth operation of financial markets, and consolidate the continued recovery of the economy. It was also reported that PBoC's Deputy Governor attended the ASEAN, China, Japan, and South Korea Finance and Central Bank deputies meeting on April 8th-9th where the impact of US tariffs on global and regional macroeconomic situation was discussed.

- EU leaders plan a trip to Beijing in July for a summit with Chinese President Xi Jinping, while it was separately reported that Spanish PM Sanchez called for mutually beneficial relations with China during a visit to Beijing.

- China Jan-Mar vehicle sales +11.2% Y/Y (prev. +10.6% Y/Y); March +8.2% (prev. +34.4% Y/Y)

- JD.com (9618 HK) to launch CNY 200bln special funds to support domestic sales of export products

NEVER MISS THE NEWS THAT MATTERS MOST

ZEROHEDGE DIRECTLY TO YOUR INBOX

Receive a daily recap featuring a curated list of must-read stories.