European futures continue gains despite confused declines on Wall Street - Newsquawk Europe Market Open

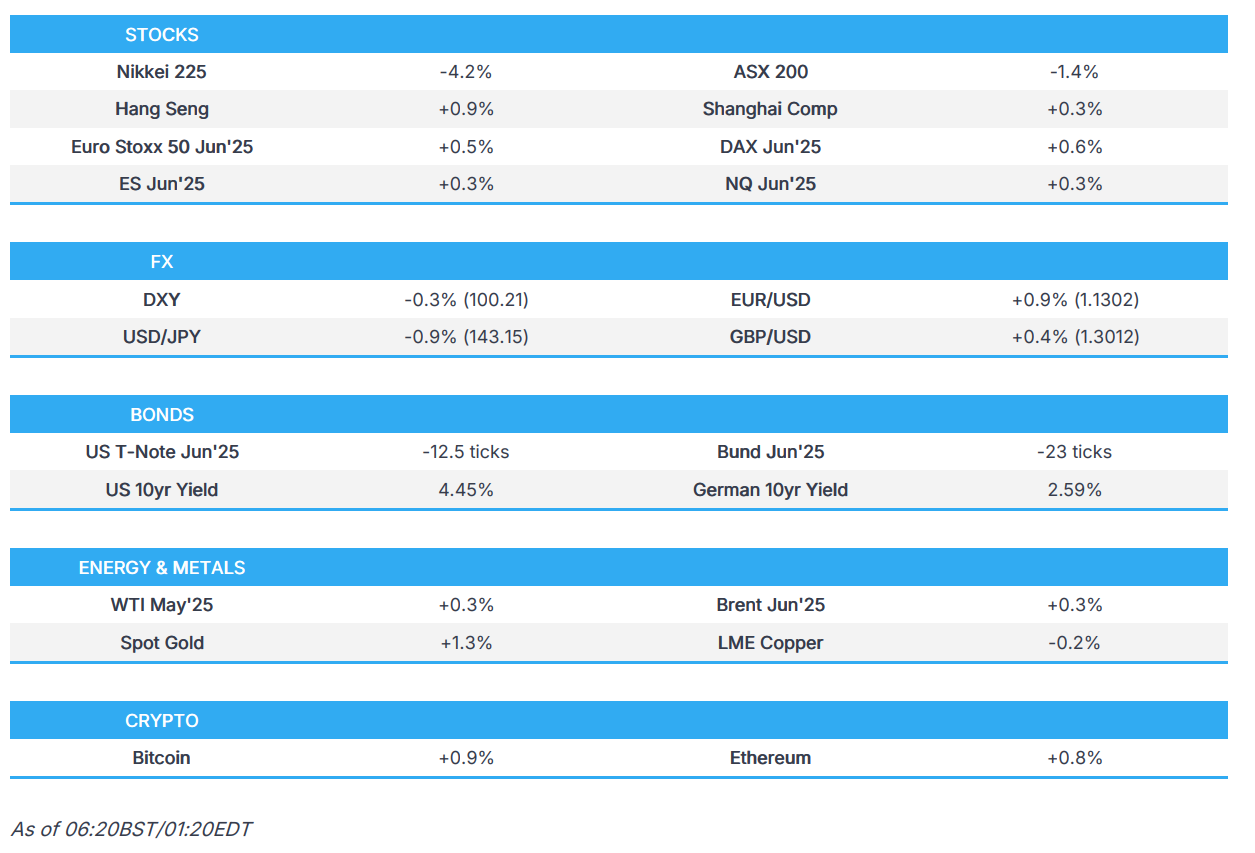

- US stocks pared some of Wednesday's historic gain, the Dollar was heavily sold, while the long-end of the Treasury curve saw further selling despite a strong US 30yr auction.

- The risk-off mood further exacerbated after reports that the White House clarified that US tariffs on China now totalled 145% after the latest hike (20% already in place + 125% added this year).

- APAC stocks mostly followed suit to the declines on Wall St, DXY suffered another bout of selling pressure, 10yr UST futures were lacklustre following the recent volatility.

- European equity futures indicate a positive cash market open with Euro Stoxx 50 futures up 0.5% after the cash market closed with gains of 4.3% on Thursday.

- Looking ahead, highlights include UK GDP, US PPI, UoM Prelim, Moody’s review on France, UK, Italy, Spain & Switzerland's Credit Rating, Speakers including Fed’s Musalem, Williams & BoE’s Greene, Supply from Italy, Earnings from JPMorgan, BlackRock, Wells Fargo, Bank of New York Mellon, Morgan Stanley & Fastenal.

SNAPSHOT

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks pared some of Wednesday's historic gains after President Trump's tariff "pause" ex-China, with the major indices heavily sold (SPX -3.5%, NDX -4.2%, DJI -2.5%, RUT -4.3%) and the NDX even flirted with the 7% losses circuit breaker at one point.

- The move away from US assets was notable as the Dollar was heavily sold, to the benefit of all G10 FX peers, while the long-end of the Treasury curve saw further selling despite a strong US 30yr auction and with the risk-off mood further exacerbated after reports that the White House clarified that US tariffs on China now totalled 145% after the latest hike (20% already in place + 125% added this year).

- SPX -3.46% at 5,268, NDX -4.19% at 18,344, DJI -2.50% at 39,594, RUT -4.27% at 1,831.

- Click here for a detailed summary.

TARIFFS/TRADE

- US President Trump said plenty are working to make a deal and he thinks it's going to work very well, while he added there have been transition problems, but in the end, it will be an incredible thing. Trump also said they may buy ships from other countries and reiterated he would love to get a deal with China and think they will end up working out something good for both countries. Furthermore, he said the first deal on tariffs is very close and they will go back to where they were if they can't make a deal, while he is looking at the EU as one block on tariffs and is not looking to hurt Mexico.

- US President Trump posted on Truth Social that "Mexico owes Texas 1.3mln acre-feet of water under the 1944 Water Treaty, but Mexico is unfortunately violating their Treaty obligation," while he threatened "escalating consequences, including TARIFFS and, maybe even SANCTIONS, until Mexico honors the Treaty, and GIVES TEXAS THE WATER THEY ARE OWED!".

- Mexican President Sheinbaum stated that Mexico sent a proposal to the US to address water deliveries to Texas and she has instructed her administration to contact US officials and is sure an agreement will be reached, while she noted Mexico has been complying with the treaty as water availability allows, amid three years of drought.

- White House trade advisor Navarro said they are going to get deals from Australia, India, and the UK, and that those three are all coming in.

- US President Trump's administration is moving towards a possible delisting of Chinese public Co. shares on US exchanges with incoming SEC chair Paul Atkins likely to take up the delisting issue when he officially takes office, according to FBN's Gasparino citing sources.

- EU Commission President Von De Leyen said could tax big tech if Trump trade talks fail, while she added the EU would seek a "completely balanced" agreement with the US during Trump's 90-day pause in applying additional tariffs and there is a wide range of countermeasures in case the negotiations are not satisfactory, according to FT.

- EU Trade Commissioner Sefcovic and Chinese Commerce Minister Wang Wentao agreed to look into setting minimum prices rather than duties for China-made EV imports.

- Vietnam plans to crack down on illicit transhipment of goods from China to the US amid Trump tariff risks.

NOTABLE HEADLINES

- Fed's Collins (2025 voter) said rate policy is well positioned and holding steady for now seems best, while she added they may yet find space to lower rates this year and that tighter financial conditions may restrain activity. Collins said that policy is still positioned to lower inflation pressures and she sees upside inflation risks and downside growth risk, as well as noted that monetary policy needs to be nimble in an uncertain environment.

- Fed's Goolsbee (2025 voter) said the Fed timetable is not the market timetable and the Fed's goal is to find through line and not jump to conclusions, while he added there's an argument that short-term tariffs would not alter the economy's path. Goolsbee said now is the time for the Fed to wait and forecast on interest rates and the Fed should keep all policy act.

APAC TRADE

EQUITIES

- APAC stocks mostly followed suit to the declines on Wall St where the major indices gave back a chunk of their historic gains as tariff uncertainty lingered and with the US clarifying China tariffs were at 145%, not 125%.

- ASX 200 was pressured amid underperformance in energy, healthcare and tech, while gold miners outperformed after prices of the precious metal extended to fresh record highs.

- Nikkei 225 briefly fell beneath the 33,000 level with exporters hit by a firmer yen and global trade uncertainty.

- Hang Seng and Shanghai Comp initially conformed to the downbeat mood after the US clarified its tariff on China was at 145% although Chinese markets gradually recouped losses amid hopes of the PBoC to step in with monetary policy support.

- US equity futures lacked firm direction after yesterday's comedown and with earnings season set to kick off.

- European equity futures indicate a positive cash market open with Euro Stoxx 50 futures up 0.5% after the cash market closed with gains of 4.3% on Thursday.

FX

- DXY suffered another bout of selling pressure and briefly declined beneath the 100.00 level for the first time since July 2023 which follows the prior day's heavy losses as participants moved away from US assets amid uncertainty due to President Trump's tariff flip-flopping and with the greenback not helped by softer-than-expected CPI data, while participants now look ahead to PPI data.

- EUR/USD rallied on the back of the slump in the dollar which helped the single currency return to above 1.1300 to print its highest in over three years.

- GBP/USD continued its gradual advances and reclaimed the 1.3000 status but with further gains capped amid light UK-specific catalysts and ahead to a deluge of economic data from the UK including monthly GDP and Industrial Production.

- USD/JPY declined owing to the weaker buck and haven demand but bounced off lows after finding support just beneath the 143.00 handle.

- Antipodeans were eventually mixed after having earlier extended on this week's gains as they took advantage of the dollar's demise despite the downbeat risk environment.

- PBoC set USD/CNY mid-point at 7.2087 vs exp. 7.3104 (Prev. 7.2092).

FIXED INCOME

- 10yr UST futures were lacklustre following the recent volatility in the treasury complex and despite a strong 30yr auction stateside, while the curve continued to steepen and participants now look ahead to PPI data.

- Bund futures took a breather after advancing yesterday as the jubilation from Trump's tariff pause withered away.

- 10yr JGB futures continued to rebound from this week's trough as risk sentiment soured and amid underperformance in Tokyo stocks.

COMMODITIES

- Crude futures remained subdued after fading some of the hefty midweek gains as the euphoria from Trump's 90-day pause petered out.

- EIA STEO sees 2025 world oil demand at 103.6mln BPD (prev. 104.1mln BPD) and 2026demand at 104.7mln BPD (prev. 105.3mln BPD).

- Russia's Novak met the Kazakh Energy Minister and discussed OPEC+ cooperation and increasing Russian oil and gas transit via Kazakhstan.

- Spot gold extended on record levels and climbed above USD 3200/oz for the first time ever amid a weaker dollar.

- Copper futures traded rangebound amid the mostly negative risk sentiment in Asia-Pac.

- Chile's Codelco copper production was down 6.1% Y/Y in February to 98,100 MT, while Escondida copper mine production rose 16% Y/Y to 113,400 MT and Collahuasi copper production fell 62.4% Y/Y in February to 17,000 MT.

CRYPTO

- Bitcoin steadily gained overnight after returning to above the USD 80,000 level.

- US President Trump signed into law a bill to nullify the IRS's expanded crypto broker rule, according to the White House.

NOTABLE ASIA-PAC HEADLINES

- PBoC will implement a moderately loose monetary policy, support the smooth operation of financial markets, and consolidate the continued recovery of the economy. It was also reported that PBoC's Deputy Governor attended the ASEAN, China, Japan, and South Korea Finance and Central Bank deputies meeting on April 8th-9th where the impact of US tariffs on global and regional macroeconomic situation was discussed.

- EU leaders plan a trip to Beijing in July for a summit with Chinese President Xi Jinping, while it was separately reported that Spanish PM Sanchez called for mutually beneficial relations with China during a visit to Beijing.

GEOPOLITICS

MIDDLE EAST

- US aggression targeted several areas in Yemen's capital with a series of raids, according to Al Jazeera.

- US Treasury updated Iran-related designations and added some Iran-linked vessels to OFAC's SDN list.

- Iran Foreign Ministry spokesperson says Tehran is giving talks with the US a genuine chance and intends to assess the other side's intent and resolve this Saturday.

- Iran wants to explore an interim nuclear deal in talks with the US before pursuing negotiations over a comprehensive deal, according to a European diplomat and a source cited by Axios.

- US President Trump is considering visiting Turkey as part of his Middle East trip next month after making stops in Saudi Arabia, Qatar and UAE, according to CNN citing sources who added no final decision has been made.

RUSSIA-UKRAINE

- British troops could be deployed in Ukraine for five years under plans being discussed by allies, according to The Telegraph.