ASTANA – As volumes of electronic commerce are growing at a rapid pace in Central Asia, postal operators, marketplaces, and logistics companies are racing to adapt. The Central Asian Postal Summit brought together executives and representatives of key postal and logistics companies on April 10 in Astana to discuss the future of e-commerce and logistics in Central Asia.

The summit, the first ever for the region, is organized by QazPost, Kazakhstan’s national post operator. Photo credit: Nargiz Raimbekova/ The Astana Times

The summit, the first ever for the region, is organized by QazPost, Kazakhstan’s national post operator.

“Right now, we are witnessing rapid growth in e-commerce, especially cross-border e-commerce. Over the past year, QazPost handled more than 20 million parcels — about half were domestic shipments within Kazakhstan, while the other half came from international trade, mostly from China,” said Azamat Keskinbayev, chief financial officer at QazPost.

Average annual growth of e-commerce ranges between 20% to 30%, he added, and the company expects this trend to solidify. To meet growing demand, QazPost is expanding its regional sorting centers and introducing more automated sorting technologies.

Keskinbayev said this growth benefits from the company’s strategic partnerships, including the one concluded with YTO, China’s leading express delivery company, in 2024.

“Together, we established a joint venture specifically focused on providing logistics services from Chinese marketplaces directly to Kazakhstan’s consumers,” he said. “The initial goal behind our collaboration with YTO was to build a major logistics operator serving the entire Central Asian market. Today, most of the volume is from China to Kazakhstan, but we’re already exploring expansion.”

Several memorandums of understanding were signed at the summit to develop logistics flows from China to other Central Asian countries, including Uzbekistan and Mongolia, through the joint venture. “In the future, we’re also aiming to expand to Europe via transit corridors,” he added.

The dynamic market of Central Asia

Central Asia today positions itself as one of the most dynamic regions in the development of e-commerce, said Damir Meirambekov, managing director for e-commerce at QazPost.

“The market is currently valued at around $9 billion, and in terms of growth rate, it is among the fastest-growing in the world. One standout example is Uzbekistan, where the market has grown nearly tenfold over the past four years,” he said.

In his remarks, he outlined several trends shaping e-commerce in the region.

Damir Meirambekov. Photo credit: Nargiz Raimbekova/ The Astana Times

“Looking at the market structure and development trends in Central Asia, it is clear, and perhaps no surprise, that the primary driver is the rise of marketplaces, both local and international. These platforms are increasingly offering full-service ecosystems and comprehensive customer support,” he said.

The growth of online trade also stems from an increased use of mobile phones. More than 70% of purchases in the region are done via a mobile phone.

“The third key trend is end-to-end logistics and the last mile [the final leg of delivery]. Today, we see that major players, before entering the market or expanding into new areas, are paying more attention to infrastructure. This includes improving logistics processes, building modern logistics hubs and sorting centers, which allows delivering better and quality services to customers,” said Meirambekov.

Over the past year alone, the e-commerce market has grown by nearly 35%, rising from 2.4 trillion to 3.5 trillion tenge.

“If we zoom in on Kazakhstan, most e-commerce businesses are currently registered in Almaty. But we are now seeing strong regional development, with new centers emerging in Astana and Karagandy,” he added.

Meirambekov also noted the growing influence of Chinese marketplaces in shaping local consumer behavior and supply.

“If we used to handle around 200,000–300,000 orders per day from Chinese marketplaces, we now expect that number to reach up to one million in the coming years. To support operations at that scale, we need to prepare the infrastructure now. That’s exactly what we’re actively working on,” he said.

Local leaders

Bringing up some figures, Meirambekov said Kaspi, the country’s fintech company, holds a leading position, accounting for more than 70% of the e-commerce market in Kazakhstan. Next comes Wildberries, with a 17.2% share.

“QazPost, as a system-forming operator in terms of logistics processes and the parcel business, plays a key role. That’s why we strive to develop and offer services that our clients can use and find valuable,” he said, highlighting the work on sorting and fulfillment centers that allow providing end-to-end logistics.

A strategic partnership with YTO also expands these processes and addresses the challenges faced on the last mile.

“In this case, it is about our automated sorting machine, which is capable of processing up to 6,000 parcels per hour. These are WMS systems – warehouse management systems. These are advanced new technologies that we are working to implement at Qazpost, along with the construction of new logistics centers that allow us to improve our processes,” Meirambekov said.

Insights from international players

Kazbek Kuzhimov, director for corporate affairs at Wildberries, also sees the rapid growth of e-commerce, both globally and in Kazakhstan, where the company has around 120,000 registered sellers. Kuzhimov said there is annual growth.

“For example, if we compare 2023 to 2024, our platform saw nearly 100% year-on-year growth in total sales. That’s a very good growth,” he said. “There has also been growth in purchases, 66%, meaning residents of Kazakhstan, final consumers, who bought goods on our platform.”

“Everyone wants to order something and have it delivered right here, right now. But to make that happen, you need infrastructure, vehicles, transport, and logistics. That’s why we also work closely with transportation companies to meet these demands,” he said.

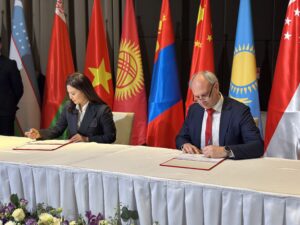

QazPost Chairwoman Assel Zhanassova and Omniva CEO Martti Kuldma sign a memorandum at the summit. Photo credit: Nargiz Raimbekova/ The Astana Times

Continuing the discussion, Sergei Lebedev, head of government relations for the Commonwealth of Independent States (CIS) at AliExpress, sees the merging of e-commerce and fintech as a key trend.

Lebedev noted that AliExpress, part of the Alibaba Group, “accustomed” people to how to shop online.

“The service that AliExpress provided required 100% prepayment by bank cards. Back in 2015, when people were just starting to buy things online and pay with cards, orders would come all the way from distant China. At that time, unfortunately, delivery could take up to a month,” said Lebedev, adding that the delivery time shortened to around two weeks.

According to him, when local marketplaces started to appear, people were already used to the idea of online shopping and embraced it quickly. On the other hand, competition from local marketplaces pushes global giants like AliExpress to deliver faster.

Tensions with local production

However, Lebedev voiced some concerns as countries are increasingly pushing for policies to protect local producers.

“Cross-border e-commerce is, unfortunately, being cast as a kind of threat. Several countries are introducing restrictions specifically targeting cross-border parcel deliveries. As you know, within the EAEU [Eurasian Economic Union], the reduction of the duty-free threshold for imported goods has long been discussed. It is now at 200 euros [$221],” he said.

Some countries, he noted, have introduced a value-added tax on cross-border e-commerce.

“To be honest, cross-border e-commerce is being unfairly demonized. The volume of goods flowing through cross-border platforms simply doesn’t have any significant negative impact on domestic production, let alone on the future development of manufacturing in CIS countries,” he added.

Because most of those deliveries are handled by national postal operators, any reduction in cross-border e-commerce would hit them first, he added.

“After all, imports are a high-margin product for postal operators. This is what postal operators earn from. We fully understand the burden national posts carry, especially the social obligations they’re expected to fulfill. In my view, government authorities and state bodies in our countries need to take a more balanced approach when regulating cross-border e-commerce, keeping in mind the pressures faced by national postal operators,” he said.