An escalating global trade war could wipe out nearly all of Slovakia’s expected economic growth next year and lead to the loss of 20,000 jobs, the country’s central bank has warned. New import tariffs introduced by the United States, and retaliatory measures by its trading partners, would push the Slovak economy into a period of pronounced uncertainty, further weakening growth already slowed by global headwinds and domestic fiscal consolidation.

According to the National Bank of Slovakia (NBS), global economic growth could fall by up to 1.2 percentage points over the next two years if the proposed tariffs between the US, EU, China, Canada and Mexico are implemented. This would represent a significant drop, given the average global growth rate hovers around 3 percent annually.

Despite Slovakia’s relatively modest direct export exposure to the US — just 4.2 percent of total exports — the economy is particularly vulnerable due to its deep integration into global supply chains and heavy reliance on industrial exports, especially vehicles. Car exports alone account for 2.5 percent of Slovakia’s GDP, far above the EU average of 0.3 percent.

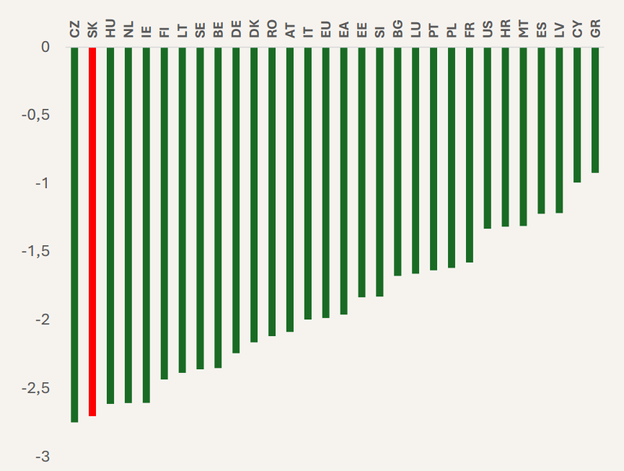

“Slovakia would be one of the most affected economies in the EU,” said Michal Horváth, chief economist at the NBS, who presented the bank’s latest spring forecast. In a worst-case scenario, he added, Slovakia’s GDP would be 2.7 percent lower by the end of 2027 — equivalent to a €3 billion loss — largely due to knock-on effects from other export-oriented countries that also trade with the US.

The brunt of the impact would be felt in the industrial sector, particularly among car manufacturers and their suppliers. Volkswagen’s Bratislava plant, for instance, sends every fourth car it produces to the United States. However, other sectors — including transport, construction and wholesale trade — would also suffer from reduced demand and delayed investment.

The introduction of new US tariffs would likely hit hardest in 2026, cutting economic growth by 1.6 percentage points that year — almost entirely erasing the projected 1.9 percent growth rate. Overall, Slovak exports could decline by 6.2 percentage points, or nearly €5 billion. While the direct decline from reduced Slovak exports to the US would be minor, at just 0.4 percentage points, indirect effects through disrupted supply chains account for the remaining 5.8.

Adding to the challenge is growing domestic uncertainty triggered by the government’s fiscal consolidation efforts. The NBS noted that investment fell sharply at the end of last year, with firms citing unclear budgetary plans and concerns about energy prices.

“The announcement of the consolidation package in October 2024 caused the highest increase in economic uncertainty in the EU,” the central bank reported, citing data from the European Commission. Households and firms alike are holding back on consumption and hiring, while investment in new technologies is slowing — undermining productivity and growth potential.

The bank has revised Slovakia’s 2025 GDP growth forecast down to 1.9 percent. However, Governor Peter Kažimír warned that if trade conflicts escalate, next year could bring no growth at all. “We’re facing the prospect of a mega trade war that could cost us 20,000 jobs,” he said. Although current labour market conditions may absorb some of the impact, Kažimír cautioned that the psychological effect could be significant.

“People may begin to fear for their jobs and standard of living. That’s a turning point that could influence wage negotiations and the wider economic mood,” he said.

Despite the gloomy outlook, the NBS remains hopeful that demand from EU consumers could support a partial recovery in exports, particularly in the automotive sector. However, households are likely to tighten their belts this year, as consolidation measures, slower wage growth, and high inflation — forecast to reach 4.3 percent — begin to bite.

In the meantime, EU Trade Commissioner Maroš Šefčovič is due to meet US officials this week in Washington to discuss the proposed tariffs. While steel and aluminium have already been targeted, additional duties on cars and other goods remain a looming threat.

Pictured from left: Chief Economist of the National Bank of Slovakia, Michal Horváth, and Governor of the National Bank of Slovakia, Peter Kažimír, during a press conference on the National Bank of Slovakia’s Spring 2025 Economic and Monetary Developments, held in Bratislava on 25 March 2025. (source: TASR - Dano Veselský)

Pictured from left: Chief Economist of the National Bank of Slovakia, Michal Horváth, and Governor of the National Bank of Slovakia, Peter Kažimír, during a press conference on the National Bank of Slovakia’s Spring 2025 Economic and Monetary Developments, held in Bratislava on 25 March 2025. (source: TASR - Dano Veselský)

Cumulative impact of the trade war on GDP by 2027 (p.p.) (source: NBS)

Cumulative impact of the trade war on GDP by 2027 (p.p.) (source: NBS)