Australia's inflation drops again to 2.4 per cent in February, ASX gains ground — as it happened

Australia's inflation declined to 2.4 per cent in February, ahead of the RBA's rate meeting in April, helping the ASX to close higher.

Catch up on the day's financial news and insights from our specialist business reporters on our live blog.

Disclaimer: this blog is not intended as investment advice.

Submit a comment or question

Live updates

Market snapshot

- ASX200: +0.7% to 7,999 points (close)

- Australian dollar: +0.06% to 63.06 US cents

- S&P 500: +0.2% to 5,777 points

- Dow Jones: +0.01% to 42,587 points.

- Nasdaq: +0.5% to 18,272 points

- FTSE: +0.3% to 8,663 points

- EuroStoxx: +0.7% to 553 points

- Spot gold: -0.16% at US3,015/ounce

- Brent crude: +0.12% to $US74.48/barrel

- Iron ore: $US102.18 a tonne

- Bitcoin: -0.7% to $US87,281

Figures at approx. 4:20pm AEDT

Live values below:

Goodbye for now

That'll be it from us today. Thanks for joining us.

Opposition leader Peter Dutton will deliver his budget reply speech tomorrow night, so that will be an event on the political agenda.

The Bureau of Statistics will release new figures on wealth and finance, and household spending, so that will get a mention in our blog too.

But until then, take care of yourselves.

Best and worst performing stocks

Among the top performing stocks today were Ramelius Resources (+13 cents, +6.05%, to $2.28), Qantas Airways (+28 cents, +2.99%, to $9.63), and ANZ Group Holdings (+85 cents, +2.97%, to $29.44)

Among the worst performing stocks were Paladin Energy (-74 cents, -11.58%, to $5.65), and Boss Energy (-11 cents, -3.96%, to $2.67).

Thank you

@garethhutchens in your piece titled "It's a Cruel World", do you mean 'without a material increase in unemployment'???

- Craig

Hi Craig, yes that's what I meant! Thanks for pointing that out. I've corrected it.

ASX200 closes higher

Trading has finished on the stock market today, and the S&P/ASX200 index has gained 56.5 points (+0.71%), to close on 7,999 points.

Why walk when you can 'walk'

At least your Adelaide colleagues tried. Sir Humphrey would be proud of Minister Butler. We will just carry on with what we’re doing even though we know it doesn’t work!

- Phillip

Once we start dancing, we must keep dancing.

It's a cruel world

It may be one of the many cruel ironies of 2025.

The Albanese Government (and Treasury officials) have just produced a budget pointing to numerous pieces of evidence that suggest that the RBA's mythical "soft landing" for the economy has been achieved, or is just about to be achieved.

It detailed how Australia's economy has experienced a significant decline in inflation without a recession, and without a material increase in unemployment — a situation that has never been achieved in Australia's post-war history.

But just as the wheels of the economic plane have been about to touch down softly, along comes Donald Trump with his Smoot-Hawley redux tariffs, which threaten to blow the whole project up.

My colleague Michael Janda explains what's happening here:

AustralianSuper no longer has an active position in WiseTech stock

AustralianSuper's Head of Australian Equities Shaun Manuell has issued this statement:

"We have been a shareholder and strong supporter of [WiseTech] since its IPO in 2016, and it has created a significant amount of value for AustralianSuper members.

"We believe good governance is essential to delivering the value we identify in a company. As a long-term active manager, our role is to allocate members' retirement savings to the companies we think are most likely to create value over the years to come.

"We needed to see a sensible transition plan that got the balance right between governance and managing the founder’s role over time in order to continue to remain a shareholder.

"We have sold because recent developments have not met our expectations. We may reconsider our position should circumstances change."

That's in relation to this ongoing story:

How to fix the problem of illegal tobacco and organised crime?

G’day Gareth. I know the main interest today is revenue numbers and the treasurer has been asked about tobacco excise from that viewpoint , but no-one is asking the obvious follow-up question. If this government action is resulting in gang warfare , lives being threatened, buildings fire bombed and honest sellers having their business income decimated , what will it take for the government to back pedal?

- Phillip

Hi Phillip,

Our colleagues Jules Schiller and Sonya Feldhoff on ABC Adelaide spoke to the Federal Health Minister Mark Butler about that very point today.

Here's the transcript of that part of their conversation.

SCHILLER: Can I ask about the black hole in your budget because of tobacco excise?

Now you have continually put up the tobacco excise. We learnt that this has cost the federal government and also us taxpayers $7 billion over five years. We know a lot of that money now has gone to organised crime organisations. And because of that we have to spend even more money on Border Force and also police enforcement. Do you now admit that this is a policy failure, that we're not stopping people smoking? All it is doing is costing other taxpayers who don't smoke billions of dollars?

BUTLER: No, I don't accept that. I do accept we've got a very serious problem with organised crime getting their mitts into illicit tobacco, but also into vapes as well. But this is a global phenomenon. If you look at countries like the US that have very significantly lower prices for their legal cigarettes than Australia does, they also have organised crime in this market. This idea that we lower the legal price of cigarettes a little bit, that will just push organised crime out of the illicit tobacco market is rubbish. It doesn't bear analysis anywhere in the world. The only answer to this is to take them on. Is to basically boost enforcement resources, end up putting them in the dock and take the sort of action that, frankly, I think the South Australian government is leading the nation on.

FELDHOFF: Minister, Bud has texted us, he says “the government are taking tobacco consumers for idiots. I'm on a low income and I was going broke before each payday. Even if illegal tobacco shops are shut down, don't forget that some people deliver and will go deeper underground. The government only has themselves to blame.”

BUTLER: Look the very clear view of all of the tobacco control experts is that the most significant tool in the toolbox to cut smoking rates in the community is price. It's not the only one, but it is the most significant one, which is why -

FELDHOFF: But it's not working. They're getting cheaper tobacco elsewhere?

BUTLER: There is still an organised crime market that is selling illegal cigarettes, as there is in pretty much every single country in the world, regardless of the price of their legal cigarettes. And that's because this is a very significant source of revenue to bankroll the other criminal activities that organised crime do. But I just don't understand what the view, of people who take this approach is, do we halve the price of legal cigarettes? Because I can tell you, I can point to country after country that has much cheaper legal cigarettes, still has organised crime, but has much higher rates of smoking.

SCHILLER: Well, why have you frozen the excise on beer then? I mean, if you're saying that the best way to reduce social harms is to increase an excise on an item that does cause, you know, the health system to buckle. And we know that alcohol, you know, feeds into domestic violence and the health system. Why have you frozen that on beer?

BUTLER: That's a modest one-off tourism and hospitality related venture. What we're talking about, as you know, is, a long-term effort to drive down smoking rates, which still kills more than 20,000 Australians every year. Now we have some of the lowest smoking rates in the world -

SCHILLER: But I'm asking about alcohol though?

BUTLER: And higher cigarette prices in the world and that is not a coincidence. It's been a product of deliberate effort by, frankly, governments of both political persuasions.

It's an interesting situation because it's not like these problems with organised crime began yesterday.

If you remember, the former Coalition government established the Illicit Tobacco Taskforce (ITTF) back in 2018 to deal with this problem, so the problem has been festering for many years.

Weaker inflation adds weight to argument for a post-election rate cut

After today's slightly weaker-than-expected monthly inflation data, CBA's economics team say they don't think it's enough to see the RBA deliver a rate cut at its April meeting, but they now have "higher conviction" of a rate cut in May.

The RBA's May meeting with occur on May 19-20 - so that will be after the election.

"Today’s data gives us more confidence the underlying inflation pulse remained relatively benign," Stephen Wu, CBA senior economist, said.

"We saw further progress on market services disinflation, as expected. We expect the RBA’s preferred measure of market services inflation to have eased to 3.5%/yr.

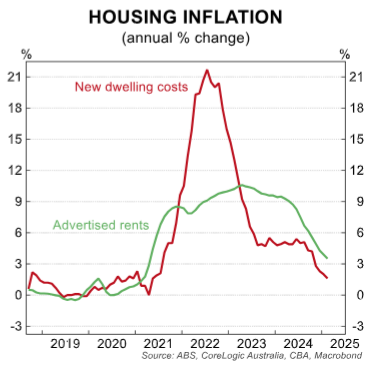

"There was once again better news on housing inflation, with new dwelling costs in deflation and recording its third monthly price fall in the past four months."

"To be clear, there remains pockets of elevated inflation," he said.

"But these look now increasingly concentrated in administered price changes where outcomes are largely indexed (whether directly or indirectly) to past inflation.

"Over time this indexation will pick up the substantial disinflation that occurred over the second half of 2024, when headline inflation fell below 3%/yr.

"Following today’s partial data, we maintain our point forecast for March quarter 2025 trimmed mean CPI at 0.6%/qtr, i.e. below the RBA’s latest estimate.

"Some better‑than‑expected component‑level outcomes have meant we downwardly revised our forecast for headline CPI from 0.9%/qtr to 0.8%/qtr.

"That leaves us with a higher conviction for a May rate cut. But we do not think it is enough to see the RBA deliver rate relief at its April meeting."

Hundreds of jobs to go at Jeanswest

My colleagues Kate Ainsworth and Emilia Terzon have more on the breaking news about Jeanswest entering voluntary administration.

They say Jeanwest's collapse follows the closure of retail group Mosaic, which owns Australian chains including Rivers, Noni B and Katies.

Mosaic collapsed last year with 250 people in head office and 2,500 workers across 651 stores in Australia and New Zealand. It owed creditors almost $250 million. Mosaic's workers are owed $21 million in entitlements like pay and annual leave.

Price increases over time

This is a total lie. for me, council rates UP 30% insurance UP 46% electricity UP 9% car servicing UP 15% phone UP 50% internet UP 10% coffee UP 20% eggs UP 25% ...this is worst than a joke it's an insidious lie and crime against the people...inflation is surging UP not down at all!

- Jon

Hi Jon,

Are you able to write back in to tell us what timeframe you're talking about? Did those price increases occur in February, in the last year, or in the last five years?

Jeanswest enters voluntary administration

The bricks-and-mortar retail operations of iconic fashion brand Jeanswest are being shuttered.

Harbour Guidance Pty Ltd, which rescued Jeanswest after it entered administration in 2020, has decided to put the company into voluntary administration.

It has appointed Lindsay Bainbridge, Andrew Yeo and David Vasudevan of Pitcher Partners Melbourne.

It says the bricks-and-mortar stores will close "in due course," but the brand and online store may be continuing and all restructuring options remain open.

Jeanswest currently operates from more than 90 locations in Australia and employs over 600 staff.

In a press release, Mr Bainbridge said the company had fought for five years to revive the 53-year-old brand but had concluded it was time to step back from physical stores to focus on online retail.

He said trading conditions for Australian retail had become increasingly tough amid reduced discretionary spending and increased cost of living.

"The owners have done everything they can to keep Jeanswest going, but market conditions mean sustaining bricks-and-mortar stores is not viable and unlikely to improve," he said.

"They deeply regret the impact of store closures on their teammembers and their customers, and we will be working now with teams across the country."

He acknowledged the impact of the decision on staff.

"This is a hard day for hundreds of Jeanswest teammembers and we will be working directly with the team members to provide clarity and information about the next steps," he said.

Mr Bainbridge said he expected all store stock to go on immediate sale as the administrators began the process of restructuring the business.

"We will be opening the doors of all stores and selling online to clear all stock to secure a return to creditors," he said.

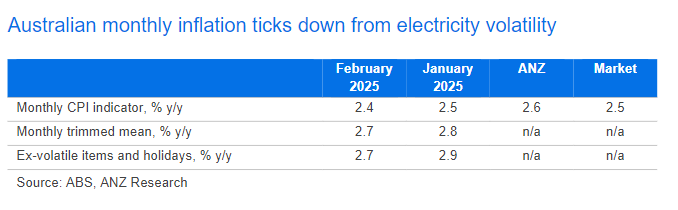

Inflation slightly weaker than ANZ expected

ANZ economist Adelaide Timbrell says the February monthly CPI indicator came in a little weaker than her team was expecting.

She says there's now some "downside risk" to ANZ's forecast of 0.7% quarter-on-quarter (or 2.9 per cent year-on-year) for trimmed mean inflation for the March quarter.

"Downside risk" means there's a chance ANZ's forecasts for underlying inflation will end up being too high.

"The volatility of electricity prices, including a fall of 2.5% m/m after a rise of 8.9% m/m in January is key to the lower than expected result," she says.

"The RBA is likely to look through this slight drop in the headline and may find the monthly trimmed mean result encouraging for disinflation progress but only at the margin.

"The Budget 2025-26 $1.8 billion extension of the energy bill relief fund to the end of 2025 will put a small amount of downward pressure on inflation in the second half of the year if implemented.

"Pharmaceuticals subsidies will have a negligible effect on the CPI.

"The tax cuts announced in the Budget will add to household finances but will be modest in aggregate and would not apply until the second half of 2026 if implemented.

Market snapshot

- ASX200: +0.7% to 8,000 points

- Australian dollar: flat to 63.01 US cents

- S&P 500: +0.2% to 5,777 points

- Dow Jones: +0.01% to 42,587 points.

- Nasdaq: +0.5% to 18,272 points

- FTSE: +0.3% to 8,663 points

- EuroStoxx: +0.7% to 553 points

- Spot gold: +0.18% at US3,025/ounce

- Brent crude: +0.12% to $US74.48/barrel

- Iron ore: $US102.18 a tonne

- Bitcoin: -0.21% to $US87,706

Figures at approx. 1pm AEDT

Live values below:

Will the budget's 'cup of coffee' tax cut be a boost for business?

Businesses reliant on Australian workers to buy their goods and services will cheer news the federal budget will leave more cash in the pockets of their customers.

Australian firms big and small have faced the crunch of higher costs. At the same time, households have seen their own budgets squeezed.

The pre-election budget will provide small relief on both sides of the ledger — with about 1 million small businesses to receive another $150 in energy bill rebates, while a worker on average earnings will receive a $536 additional tax cut from 2027-28.

AMP chief economist Shane Oliver described the additional tax cut as "trivial" for individual households, despite the cost to the budget.

"For the first year they operate … it's just $5 a week for a person on average wages, and for the second year, it's just $10 a week, so it won't even buy you a sandwich and a milkshake," Dr Oliver said.

Despite the modest size of the cuts, independent economist Nicki Hutley expects them to be broadly welcomed.

"Yes it's at the margin, but it's not the first time governments have delivered small, cup-of-coffee-type tax cuts and got rewarded for it."

But businesses may face more competition to hang on to their staff, with the budget providing reforms to abolish non-compete clauses for most workers — a development attracting criticism from the Australian Industry Group.

Industry lobby groups have mostly expressed disappointment with the budget, which did not extend the instant asset write-off from recent years.

Loading...Read more about what's in the budget — and what's missing — here:

X v eSafety Commissioner in court now

What's Elon up to today?

Jumping in to tell you about a big case going on right now in Federal Court in Melbourne.

It's X CORP. V ESAFETY COMMISSIONER or in lay terms, Elon Musk's social media service previously called "Twitter" (now X) taking on Australia's independent regulator for online safety.

It's in relation to a judgment late last year that ruled X Corp was "obliged to respond to a transparency notice seeking information about measures to address the proliferation of child sexual exploitation material on its platform".

As in, do something about the heinous illegal content on your site.

At the time, our eSafety Commissioner Julie Inman Grant welcomed the Court’s rejection of X Corp's argument that it didn't have to respond because the notice was given to the former entity, Twitter Inc.

"Early last year, we asked some of the world's biggest technology companies, including Twitter, to report on steps they were taking to comply with the Australian Government's Basic Online Safety Expectations in relation to child sexual exploitation and abuse material on their platforms.

"Had X Corp’s argument been accepted by the Court it could have set the concerning precedent that a foreign company's merger with another foreign company might enable it to avoid regulatory obligations in Australia."

Separately, eSafety commenced civil penalty proceedings against X Corp in relation to its alleged non-compliance with the transparency notice.

Today's hearing is about that original decision, and there's already been a lot of discussion about "Nevada law" and whether X Corp is liable for Twitter issues.

That's where we're at, in front of Justices Murphy, Charlesworth and Horan today.

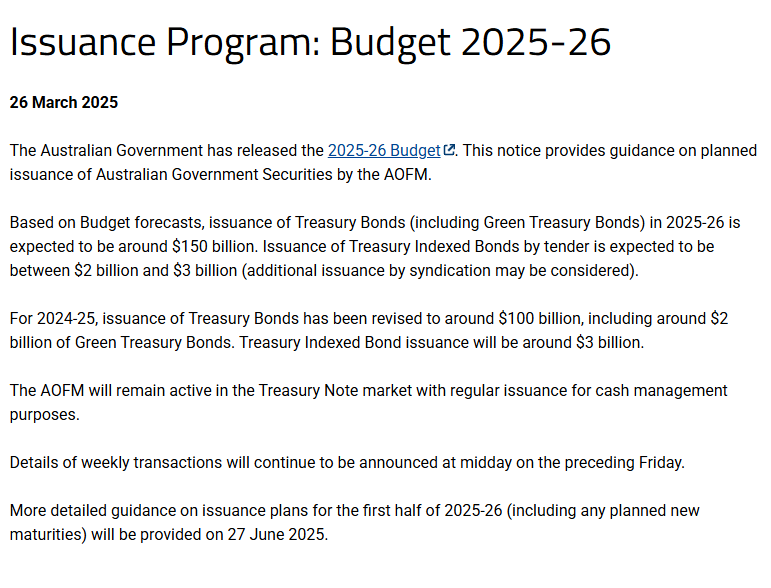

Why is the AOFM planning to issue over $100 billion in Treasury bonds?

Why is the Government selling $100 billion of gov treasury bonds and what is that paying for?

- chrisso

Hi Chrisso, that would relate to the Albanese government's budget plans.

You can find that information on the website of the Australian Office of Financial Management (AOFM).

Dropping inflation won't change the RBA's mind next week, KPMG economist says

KPMG economist Brendan Rynne just spoke to Alicia Barry on the ABC News channel, where he went through the latest monthly CPI figures with her live.

For a recap: Australia's annual inflation rate has dropped again, with it slightly down in February to 2.4 per cent for headline inflation.

The RBA cut the cash rate last month, arguing that price shocks in the economy are moderating.

Yet Dr Rynne is not expecting the central bank to drop interest rates again at its next meeting on Tuesday, April 1.

He cites the increasingly divisive NAIRU, where it is thought that unemployment needs to sit at a certain level to keep price shocks down.

Here's what he says:

The latest labour market read showed the unemployment rate is still remaining steady at 4.1 per cent. That is below our estimate for NAIRU.

We still [expect] that there's some pressure that is going to come through the labour market and wages later in the year.

Which means the Reserve Bank is going to be cautious, necessarily about wanting to have back-to-back drops in the interest rate.

A reader's perspective on non-compete clauses

Personally I believe the removal of non-compete clauses is a positive thing. I worked for a big 4 consultancy, in human resources, and had a non-compete clause that meant I couldn't work with a raft of industry peers and clients, despite the fact that I did no client facing work. It made no sense and limited career opportunities for 6 months (the duration of the clause). Perhaps it will encourage employees to not take a "one size fits all" approach.

- Stu

Thanks for your comment Stu.