In 2024, U.S. courts issued consequential decisions in cases brought against foreign states and their agencies and instrumentalities under the Foreign Sovereign Immunities Act (“FSIA”).1 This alert summarizes key decisions in FSIA cases and other litigation involving foreign sovereign defendants and discusses developments that will likely have significant implications for litigation involving foreign sovereigns in 2025 and beyond.

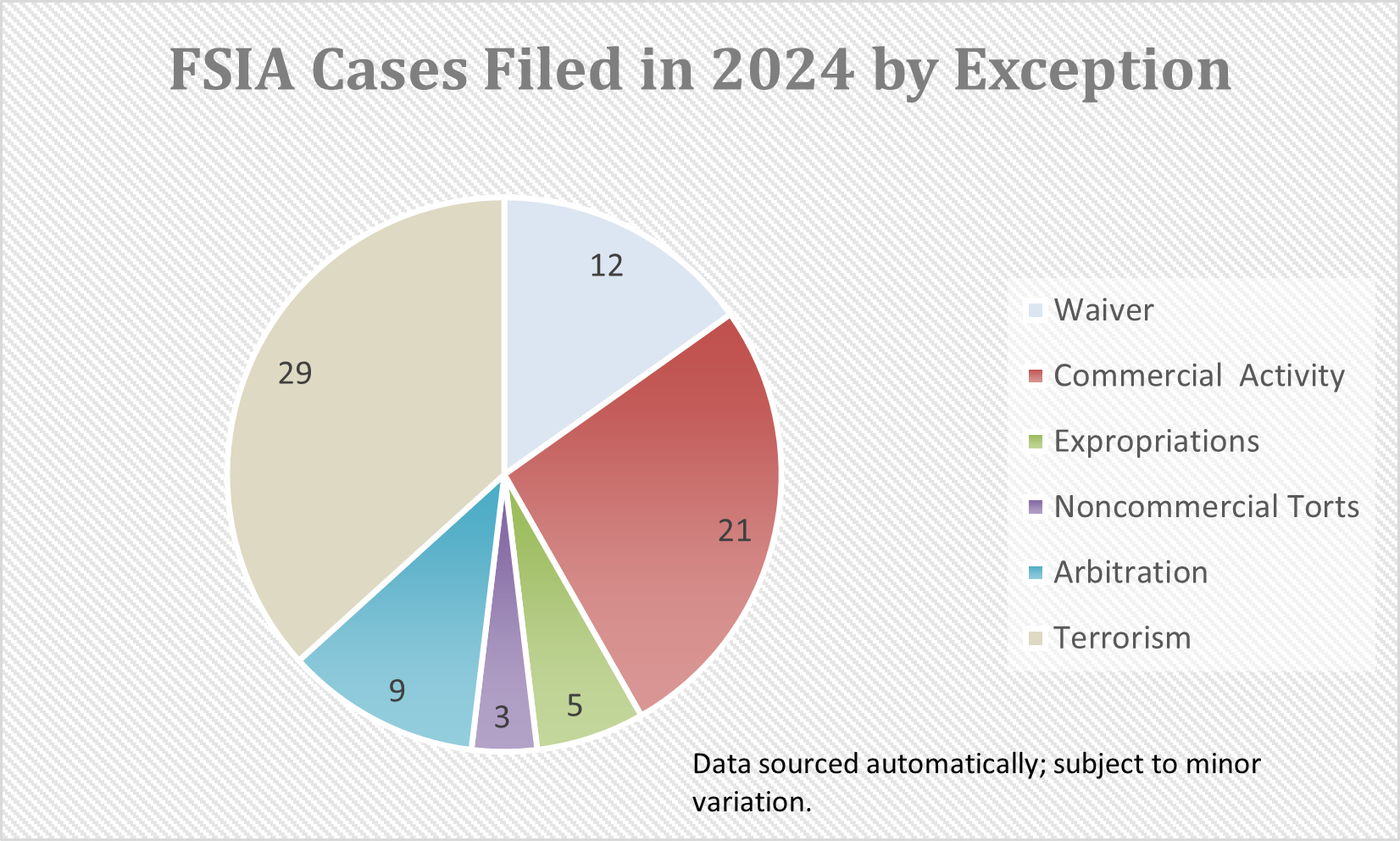

The FSIA provides the sole basis for jurisdiction in U.S. courts over foreign states and their agencies and instrumentalities. Although such entities are presumptively immune under U.S. law, they are subject to jurisdiction in U.S. courts when one of the FSIA’s exceptions to immunity applies and service is properly effected. Nearly 80 new civil actions under the FSIA were filed in federal courts in 2024, indicating that U.S. courts remain an attractive forum for claims against foreign sovereign defendants. The majority of these cases were brought under the FSIA’s terrorism exception – which applies when the action seeks damages for personal injury or death caused by an act of terrorism, or material support for such an act, by a designated state sponsor of terrorism – or the commercial activity exception – which applies when the action is based on commercial activity performed in the United States or with direct effects in the United States. Cases involving a foreign state’s waiver of immunity or efforts to confirm and enforce arbitration awards against foreign states remained active areas of litigation as well.

Key developments in 2024 include:

- The Supreme Court granted certiorari to address several key FSIA issues during its 2024-2025 term. After granting cert and hearing oral argument in 2024, the Court issued a decision in February 2025 in Republic of Hungary v. Simon, holding that the requisite commercial nexus to the United States had not been satisfied in an expropriation case where Hungary allegedly took property in violation of international law from Hungarian Holocaust victims, commingled the expropriation proceeds with other government funds, and later used funds from those commingled accounts in connection with commercial activities in the United States. The Court held that such commingling allegations alone are insufficient to establish the required commercial nexus with the United States. The Supreme Court heard oral argument in CC/Devas (Mauritius) Limited v. Antrix Corp. Ltd., which has the potential to raise the bar for plaintiffs seeking to establish personal jurisdiction over foreign state defendants. The Supreme Court also granted, vacated, and remanded in a case concerning the law applicable to determining ownership rights in art expropriated by the Nazi regime, and is considering cert petitions in several consequential cases involving the FSIA’s terrorism, arbitration, expropriation, and commercial activity exceptions.

- The D.C. Circuit weighed in on key cases concerning the confirmation and enforcement of arbitration awards against foreign sovereigns. Notably, the D.C. Circuit held that U.S. courts have jurisdiction to enforce arbitral awards issued in intra-EU disputes under the Energy Charter Treaty in NextEra Energy v. Kingdom of Spain. This decision may prompt further involvement of U.S. courts in European disputes as holders of awards arising from intra-EU disputes have increasingly turned to U.S. courts to enforce their awards. This trend follows decisions from the EU’s highest court holding that intra-EU arbitration is incompatible with EU law and decisions by national courts in several EU member states to annul, or refuse enforcement of, intra-EU awards.

- The Second Circuit issued important decisions in cases brought by holders of sovereign bonds issued by foreign states. For example, the decision in Petróleos de Venezuela, S.A. v. MUFG Union Bank, N.A., held that the validity of Venezuelan bonds is a question of Venezuelan law, rather than New York law. Although the bondholder plaintiffs may still establish liability for PDVSA’s defaults on the bonds, the decision has further delayed their efforts and may make it impossible for them to join ongoing enforcement and attachment litigation by U.S. judgment holders in the U.S. District Court for the District of Delaware. The district court has ordered the sale of PDVSA’s subsidiary, PDVH, to satisfy more than $20 billion in judgments against Venezuela and PDVSA.

- Plaintiffs continued to file new cases under the FSIA’s terrorism exception, which applies to claims against designated state sponsors of terrorism for damages caused by violent attacks, hostage-taking, torture, and other acts of terrorism. Of the 29 such cases filed in 2024, the majority were filed in the U.S. District Court for the District of Columbia. In 2024, the number of cases filed against Syria increased to 10 while the number filed against Iran decreased to 20. Courts in 2024 issued large punitive damages awards to plaintiffs, notwithstanding concerns expressed by some judges that such awards may not deter terrorism and may impose foreign policy burdens on the U.S. government.

- Federal courts issued decisions in a number of consequential cases concerning the FSIA’s expropriation and commercial activity exceptions. Some of these decisions narrowed the scope of these exceptions, making it potentially more difficult for plaintiffs to establish jurisdiction over foreign states in similar cases. However, other decisions demonstrate the continuing viability of these exceptions for vindicating the rights of U.S. litigants who have been harmed by foreign state conduct.

These developments are discussed in further detail below.

2024-2025 Litigation Developments:

1. The Supreme Court Has Decided – Or Will Decide – Several Key FSIA Issues During Its 2024-2025 Term

The Supreme Court has decided, or soon will decide, several important FSIA cases during its 2024-2025 term that will affect the ability of plaintiffs to establish jurisdiction over foreign states or their agencies or instrumentalities. Additionally, the Court is or will be considering cert petitions in numerous cases involving different exceptions to immunity under the FSIA.

On February 21, 2025, the Supreme Court issued a unanimous ruling in Republic of Hungary v. Simon, a case brought by Hungarian Holocaust survivors and their heirs seeking compensation for property that the Hungarian government expropriated during the Holocaust.2 This is the second time that the Simon case has reached the Supreme Court. The question presented in Simon was whether the plaintiffs could satisfy the commercial nexus requirement of the FSIA expropriation exception by showing that Hungary commingled proceeds from the sale of the expropriated property with other government funds and then used those general government funds in connection with commercial activity in the United States, or whether the plaintiffs must show a tighter connection between the expropriated property and the funds used in connection with commercial activity in the United States.

The Court rejected the Simon plaintiffs’ “commingling” theory, holding that plaintiffs must have evidence to show that funds used in connection with commercial activity in the United States are traceable to their expropriated property. The Court reached this decision despite concerns expressed at oral argument that rejecting the plaintiffs’ commingling theory could make it easier for foreign states to expropriate property with impunity.3 While the Court concluded that this “tracing” requirement did not entirely foreclose jurisdiction under the expropriation exception where the expropriated property has been sold for money, it likely makes it more difficult for plaintiffs to maintain expropriation claims against foreign sovereigns in U.S. courts in these circumstances. That may be the case particularly when there is a significant time lapse between the alleged expropriation and the timing of the alleged commercial activity using the proceeds (as there was in the Simon case).

Notably, the decision appeared to be driven at least in part by a concern that adopting the plaintiffs’ commingling theory would de-couple the expropriation exception from international law – an argument raised by the U.S. Solicitor General in an amicus brief filed in support of Hungary.4 Adopting in large part the Solicitor General’s views, the Court expressed concerns that the expropriation exception already “goes beyond even the restrictive view” of foreign sovereign immunity “[b]y permitting the exercise of jurisdiction over certain public [as opposed to private] acts” and noting that “it appears that ‘no other country has adopted a comparable limitation on [foreign] sovereign immunity.’”5

The Court remanded the case for further proceedings consistent with the opinion. Read WilmerHale’s further analysis of the Simon decision here.

Next up for the Court is CC/Devas (Mauritius) Limited v. Antrix Corp. Ltd., which concerns the conditions that must be met for a federal court to assert personal jurisdiction over foreign states sued under the FSIA.6 The Supreme Court is considering whether the FSIA requires plaintiffs to establish for purposes of personal jurisdiction that a foreign state has minimum contacts with the United States. The FSIA’s long-arm provision does not impose a minimum contacts analysis but instead requires that one of the FSIA’s exceptions to sovereign immunity apply and that service be properly made.7 In CC/Devas, however, the Ninth Circuit interpreted the FSIA to require a minimum contacts analysis,8 thereby creating a split with the D.C. Circuit.9 The Supreme Court could also reach the question of whether foreign states are protected by the Due Process Clause of the Fifth Amendment, such that courts must conduct a minimum contacts analysis to exercise jurisdiction over foreign states – a constitutional question that the Court has previously declined to address.

The Court heard oral argument in the case on March 3, 2025. Notably, Antrix (the Indian state-owned entity that is the defendant here) did not defend the Ninth Circuit’s interpretation of the FSIA’s long-arm provision but instead raised new arguments that it did not raise below. For example, Antrix argued that the FSIA’s arbitration exception applies only when relevant commercial activity has occurred in the United States, which Antrix contends is absent here. Given that this argument raises an issue of subject matter jurisdiction under the FSIA, rather than personal jurisdiction, several Justices suggested the case should be remanded to the lower courts to address this new argument in the first instance. This suggests that the Court may decline to decide the constitutional issues – including whether foreign states and their agencies or instrumentalities are entitled to due process rights – and instead remand the case for further consideration of the statutory questions surrounding the FSIA’s arbitration exception.

Read WilmerHale’s further analysis of the CC/Devas case here.

On March 10, 2025, the Supreme Court granted cert and vacated and remanded a unanimous decision by the Ninth Circuit in Cassirer v. Thyssen-Bornemisza Collection Foundation – a case concerning the lawful ownership of paintings stolen by the Nazis in 1939 – in light of a California law enacted in response to this dispute.10 Cassirer first reached the Supreme Court in 2021, when the Court decided that in an FSIA suit raising nonfederal claims, a court should determine the applicable substantive law by using the same choice-of-law rule that applies in a similar suit against a private party. In the Cassirer case, that meant that the forum state’s (California’s) choice-of-law rule applied rather than federal common law. In January 2024, the Ninth Circuit applied California’s choice-of-law principles and held that Spanish law applies to determine the rightful owner of the art.11 Applying Spanish law, the Ninth Circuit concluded that the defendant Spanish museum had gained prescriptive title to the painting under that law. Subsequently, California’s legislature passed California Assembly Bill 2867, which mandates the application of California law in cases brought by state residents to recover artwork stolen during the Holocaust. Plaintiffs asked the Supreme Court to grant, vacate, and remand in light of the new law, which the Supreme Court did on March 10, 2025. The Ninth Circuit will now have another opportunity to determine lawful ownership, this time under California law.

The Supreme Court is also considering cert petitions in a number of other FSIA cases. Notably, the Supreme Court recently called for the views of the United States in Borochov v. Islamic Republic of Iran, which presents the question of whether the FSIA’s terrorism exception extends jurisdiction to claims arising from a foreign state’s material support for a terrorist attack that injures or disables, but does not kill, its victims.

Additionally, United States v. Turkiye Halk Bankasi, a/k/a Halkbank, appears to be heading back to the Supreme Court. The case concerns a U.S. federal criminal prosecution of one of Turkey’s state-owned banks, Turkiye Halk Bankasi (Halkbank), for alleged violations of U.S. sanctions laws. The Supreme Court previously ruled in the Halkbank case in 2023, holding that the FSIA applies only to civil suits, not to criminal prosecutions.12 On remand, the Second Circuit considered whether Halkbank was immune from prosecution under the common law. The Second Circuit deferred to the Executive Branch’s determination that Halkbank was not immune under the common law for its commercial activities and ruled that the Executive’s determination was consistent with the scope of immunity at common law.13

The Second Circuit’s decision potentially opens the door to more prosecutions of foreign state-owned entities for alleged criminal violations of U.S. sanctions laws relating to commercial banking activities. This is particularly significant given the U.S. government’s increased focus in recent years on enforcement of U.S. sanctions laws as a tool of foreign policy. The Second Circuit decision may not be the final word, however, as Halkbank has indicated that it will seek review by the Supreme Court of the Second Circuit’s holding that Halkbank is not immune under the common law from U.S. criminal jurisdiction.

2. The D.C. Circuit Decided Several FSIA Cases Regarding the Enforcement of Arbitration Awards Against Foreign States

The D.C. Circuit weighed in on hotly contested issues regarding the confirmation and enforcement of arbitration awards against foreign state defendants in 2024.

Most notably, in NextEra Energy Global Holdings B.V. v. Kingdom of Spain, the D.C. Circuit addressed whether the FSIA’s arbitration exception grants U.S. courts jurisdiction to confirm arbitral awards issued against EU member states and in favor of investors that are EU citizens.14 For holders of such “intra-EU awards,” the applicability of the FSIA’s arbitration exception has taken on heightened importance after decisions by the EU’s highest court – starting with Slovak Republic v. Achmea15 in 2018 – held that intra-EU arbitration is incompatible with EU law and resulted in the courts of several EU member states annulling or refusing to enforce intra-EU awards. Investors holding intra-EU awards have therefore turned to U.S. courts, along with other non-EU courts, to enforce their awards against EU states.

In NextEra, the D.C. Circuit held that the FSIA’s arbitration exception grants jurisdiction to U.S. courts to enforce awards issued in intra-EU investment arbitrations brought under the Energy Charter Treaty (“ECT”), notwithstanding the Achmea line of cases. The NextEra investors – EU citizens who received awards issued in their favor against Spain – prevailed in the district court in establishing jurisdiction over Spain under the FSIA’s arbitration exception. The arbitration exception requires award holders to prove that the foreign state defendant agreed to arbitrate “with or for the benefit of a private party.”16 Spain appealed the district court’s jurisdictional decision, arguing that Spain could not be deemed to have agreed to arbitrate the investors’ claims because the Achmea line of cases precluded it from validly doing so as a matter of EU law.

The D.C. Circuit rejected Spain’s jurisdictional objection, holding that the investors had proven Spain’s agreement to arbitrate “for the benefit” of private parties “by producing copies of the ECT.”17 And whether Spain had agreed to arbitrate the claims at issue in the underlying intra-EU investment arbitration was a question of the scope of Spain’s agreement to arbitrate that the district court will answer when considering the merits of the investors’ application to confirm their awards. Although the D.C. Circuit held that Spain’s Achmea-based arguments did not preclude the district court from exercising jurisdiction over Spain under the FSIA’s arbitration exception, it left for the district court to decide whether those arguments on the merits prevent confirmation of the award against Spain.

Additionally, the NextEra panel held by a 2-1 vote that the district court improperly issued an injunction purporting to bar Spain from petitioning foreign courts to enjoin enforcement of the award (a so-called “anti-anti-suit injunction”) and therefore vacated the district court’s injunction. This calls into question the ability of award holders to stop foreign states from obtaining anti-suit injunctions in EU courts, which could effectively frustrate efforts to enforce intra-EU awards in U.S. courts.

Spain has indicated that it will seek Supreme Court review of the D.C. Circuit’s jurisdictional ruling. Read WilmerHale’s further analysis of the NextEra decision here.

Next, in Zhongshan Fucheng Industrial Investment Co. v. Federal Republic of Nigeria, the D.C. Circuit held that the New York Convention on the Recognition and Enforcement of Foreign Arbitral Awards governs awards issued in investor-state arbitrations and thus provides a basis for jurisdiction to enforce such awards under the FSIA’s arbitration exception.18 Among other things, Nigeria argued that the New York Convention did not apply to awards where the foreign state was acting in its sovereign capacity, rather than in a private, commercial capacity. The panel split on this issue, with Judges Millett and Childs rejecting this argument and concluding that the New York Convention did not treat foreign states differently based on whether they acted in a “sovereign” or a “private” capacity; Judge Katsas dissented. Nigeria has petitioned the Supreme Court for certiorari.

And in TIG Insurance Co. v. Republic of Argentina, the D.C. Circuit concluded that the FSIA’s arbitration exception extends to a successor-in-interest to a contract that contains an arbitration clause.19 The case concerns efforts by TIG Insurance Co. to attach and execute a judgment against a building owned by the Republic of Argentina to satisfy arbitration awards relating to certain reinsurance contracts with a state-owned entity that had been liquidated. The D.C. Circuit reasoned that to permit a sovereign state to take over another entity’s obligations under a contract with an arbitration provision and yet escape the immunity-waiving effect of the arbitration agreement would frustrate the FSIA’s objective of holding states accountable for their commercial conduct. The D.C. Circuit remanded the case to the district court to determine whether Argentina assumed the relevant obligation to arbitrate under common-law principles of contract formation and successorship.

3. The Second Circuit Issued Consequential Rulings in Long-Running Sovereign Bondholder Cases

In 2024, the Second Circuit issued important decisions in long-running cases brought by holders of sovereign bonds issued by Venezuela and Argentina.

In Petróleos de Venezuela, S.A. v. MUFG Union Bank, N.A., the Second Circuit overturned the enforcement of nearly $2 billion in defaulted bonds issued by Venezuela’s state-owned oil company, PDVSA, and remanded the case to the district court to adjudicate the validity of certain notes issued in 2020 (“2020 Notes”) and their associated governing documents under Venezuelan, rather than New York, law.20 The district court previously held that New York law determined the validity of the 2020 Notes based on the New York choice-of-law provisions governing those Notes. On appeal, the Second Circuit certified the question to the New York Court of Appeals, which held in February 2024 that under New York law, the validity of the 2020 Notes is governed by Venezuelan law.21 However, the New York Court of Appeals ruled that New York law governs the transaction in all other respects, including the consequences of any invalidity under Venezuelan law. Following this decision, the Second Circuit vacated the district court’s judgment and remanded for the district court to consider “whether the 2020 Notes and associated instruments were issued in violation of the Venezuelan Constitution and are thus invalid.”22

The decisions of the Second Circuit and the New York Court of Appeals introduce foreign law into determining the validity of sovereign-issued securities with New York choice-of-law provisions. These decisions may create uncertainty regarding the validity of other foreign-issued securities, whose authorization procedures may involve considerations of law specific to the country that issued the securities.

Next, in Attestor Master Value Fund LP v. Argentina, the Second Circuit held that holders of defaulted Argentine bonds may attach Argentina’s reversionary interests in the collateral securing those bonds and that Argentina must turn over those reversionary interests to the bondholders.23 Argentina had argued that its reversionary interests in the collateral were immune from attachment under the FSIA.24 The Second Circuit rejected that argument, holding that Argentina had used its reversionary interests for commercial activity in the United States – one of the exceptions to attachment immunity under the FSIA.25 In particular, the court concluded that Argentina had used these reversionary interests for commercial activity in the United States by offering to exchange the defaulted bonds for proceeds of the collateral securing them, as well as new debt that Argentina would issue, “as any non-sovereign entity might do.”26 The Supreme Court denied cert on January 27, 2025, meaning that Argentina’s reversionary interests are now subject to attachment and turnover.

4. Plaintiffs Filed Dozens of New Cases Against Designated State Sponsors of Terrorism Under the FSIA’s Terrorism Exception

In 2024, plaintiffs filed 29 new FSIA terrorism cases, 83% (24) of which were filed in the U.S. District Court for the District of Columbia. Notably, there were significantly more cases filed against Syria, with 10 cases filed in 2024; this is up from just one in 2023, four in 2022, and five in 2021. The number of cases filed against Iran decreased slightly, with 20 cases filed against Iran in 2024, compared to 21 in 2023 and 27 in 2022.27

As in previous years, courts decided numerous FSIA terrorism cases. The largest judgment of the year came in Gunn v. Islamic Republic of Iran, where Judge Contreras ordered Iran to pay nearly $2 billion to the survivors and families of sailors killed in the 2000 terrorist bombing of the USS Cole. This award included $1.48 billion in punitive damages.28 Although the majority of courts award large punitive damages in FSIA terrorism cases, some judges have raised concerns that large damages awards have limited deterrent effect and instead may impose foreign policy burdens on the political branches of the U.S. government.29

Looking ahead, FSIA terrorism litigation is likely to remain active in 2025, driven by Iran’s continued involvement in terrorism, hostage-taking, and regional wars involving Hamas, Hezbollah, and other terrorist organizations. Time will tell whether U.S. courts continue to issue judgments with large punitive awards and whether more judges will express skepticism about the effectiveness or necessity of large punitive awards in these cases.

5. Plaintiffs Achieved Mixed Results in FSIA Expropriation Exception Cases

In addition to Republic of Hungary v. Simon, federal courts decided several other cases under the FSIA’s expropriation exception in 2024, some of which will likely make it more difficult for plaintiffs to maintain such suits in the future. In Agudas Chasidei Chabad of United States v. Russian Federation, for instance, the D.C. Circuit reversed the plaintiffs’ long-standing FSIA judgment against Russia and held that the district court lacked jurisdiction over the Russian Federation under the FSIA’s expropriation exception because the expropriated property (religious texts and other religious property) was not located in the United States.30 Consequently, the D.C. Circuit concluded that there was no basis for Chabad to seek attachment of property belonging to Russia’s agencies or instrumentalities to satisfy judgments that Chabad holds against the Russian Federation. This decision was a blow for Chabad, which had obtained a default judgment against the Russian Federation years earlier and was seeking to execute on that judgment with respect to property located in the United States and owned by the Russian Federation’s state-owned corporations.

The decision cements the D.C. Circuit’s two-track approach to the expropriation exception’s commercial nexus requirement: one for the foreign state itself and one for the agencies or instrumentalities of the foreign state. Where the defendant is the foreign state itself, the foreign state is not subject to U.S. jurisdiction unless the expropriated property (or property exchanged for that property) is located in the United States in connection with the foreign state’s commercial activities in the United States. In contrast, where the defendant is the foreign state’s agency or instrumentality that owns or operates the expropriated property, the agency or instrumentality is subject to U.S. jurisdiction, even when the expropriated property (or property exchanged for such property) is located outside the United States, provided the agency or instrumentality is engaged in commercial activity in the United States. Other circuits are split, with the Second and Fourth Circuits supporting the D.C. Circuit and the Ninth and Eleventh Circuits holding instead that the foreign state itself is subject to jurisdiction where either commercial nexus requirement is satisfied.31 Chabad recently filed a cert petition with the Supreme Court seeking review of the D.C. Circuit’s decision. Chabad is represented by WilmerHale and Rothwell Figg.

In de Csepel v. Republic of Hungary, the U.S. District Court for the District of Columbia granted Hungary’s motion to dismiss for lack of jurisdiction on the ground that the alleged taking of artwork from Hungarian Holocaust survivors was a wartime taking covered by the law of armed conflict, rather than a peacetime taking covered by the law of expropriation.32 Accordingly, although the taking at issue in de Csepel may have violated the law of armed conflict, it does not qualify as a taking “in violation of international law” within the meaning of the FSIA’s expropriation exception.33 This decision likely makes it considerably more difficult for certain plaintiffs to bring wartime expropriation claims against foreign states under the FSIA. Plaintiffs have appealed to the D.C. Circuit.

In another important case in the same court, Helmerich & Payne International Drilling Co. v. Petróleos de Venezuela, S.A. and PDVSA Petróleo, the U.S. District Court for the District of Columbia held that it has jurisdiction over Venezuela’s state-owned oil company, PDVSA, and its wholly owned subsidiary for the alleged expropriation of the Oklahoma-based Helmerich & Payne International Drilling Co.’s rights in property, including H&P’s Venezuelan subsidiary and the drilling rigs that were seized by the government of former President Hugo Chávez.34 The decision followed extensive jurisdictional discovery, as well as two earlier trips to the D.C. Circuit and one trip to the Supreme Court. The decision is the first in which a federal court has found jurisdiction under the FSIA where the claim concerned an indirect taking of property rights – meaning, a claim that the foreign state defendant took a shareholder’s rights in its subsidiary by “completely destroying the beneficial value of those rights” (even where the subsidiary’s shares themselves were not taken).35 Plaintiff Helmerich & Payne International Drilling Co. was represented by WilmerHale.

6. Plaintiffs Frequently Invoked the FSIA’s Commercial Activity Exception in New Suits, and Federal Courts Issued Several Important Decisions on the Exception’s Scope

Plaintiffs brought numerous suits against foreign state defendants under the FSIA’s commercial activity exception, which was the second most-invoked exception in FSIA cases filed in 2024. Many of these cases were filed in federal court in Washington, D.C., with the D.C. Circuit issuing several notable decisions regarding the scope of the commercial activity exception in 2024.

Exxon Mobil Corp. v. Corporación CIMEX, S.A., was brought under the Helms-Burton Act, which provides a civil remedy for U.S. nationals against any person who “traffics” in property confiscated by Cuba, broadly defined to mean directly or indirectly profiting from confiscated property.36 In Exxon, the D.C. Circuit ruled that the Helms-Burton Act does not provide a basis for jurisdiction over foreign state defendants independent of the FSIA. As to the FSIA, the D.C. Circuit held that the expropriation exception did not apply but that the plaintiffs may have alleged sufficiently direct effects in the United States from the defendant’s commercial activities in Cuba to satisfy the FSIA’s commercial activity exception to immunity. The D.C. Circuit remanded to the district court for further analysis based on the factual record. Exxon Mobil has sought cert on the question of whether the Helms-Burton Act provides a basis for jurisdiction independent of the FSIA.

The D.C. Circuit also clarified in Wye Oak Technology, Inc. v. Republic of Iraq that, in a breach of contract case, the foreign state defendant’s commercial activity must have direct effects in the United States that were explicitly anticipated in the contract itself and are not simply an incidental result of the breach.37 Wye Oak has petitioned the Supreme Court for cert.

And in Missouri ex rel. Bailey v. People’s Republic of China, the Eighth Circuit held that Missouri’s case against the Chinese government for harms arising from the COVID-19 pandemic may proceed under a theory that the Chinese government’s hoarding of personal protective equipment, and its subsequent selling of lower-quality equipment in the United States, had a direct effect in the United States because its anticompetitive behavior caused an immediate shortage of masks in the United States.38

* * *

In conclusion, 2024 was a very active year for litigation against foreign states and their agencies and instrumentalities in U.S. courts under the FSIA. Dozens of new cases were filed under several different exceptions to immunity, with the terrorism exception and the commercial activity exception being the two most common types of exceptions to immunity for new cases in 2024. The D.C. Circuit and Second Circuit remained the two most active jurisdictions, with the Supreme Court hearing an increasing number of FSIA cases. Whereas the terrorism exception has been broadly interpreted to permit a wide range of claims to be pursued against a narrow range of states (i.e., designated state sponsors of terrorism, including only Cuba, Iran, North Korea, and Syria), the expropriation exception has been strictly interpreted to permit only a narrow range of claims to be pursued against a limited number of states engaged in the uncompensated taking of property in peacetime. Looking ahead to 2025, we expect to see a robust volume of FSIA cases involving terrorism, commercial activity, waiver, expropriations, and arbitrations, possibly fueled by increasing geopolitical and economic conflict, decreasing accountability in foreign courts, and continuing challenges with the enforcement of arbitral awards against sovereigns.

Footnotes