5 analysts have expressed a variety of opinions on Bank OZK OZK over the past quarter, offering a diverse set of opinions from bullish to bearish.

The table below summarizes their recent ratings, showcasing the evolving sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 0 | 5 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 3 | 0 | 0 |

| 3M Ago | 0 | 0 | 1 | 0 | 0 |

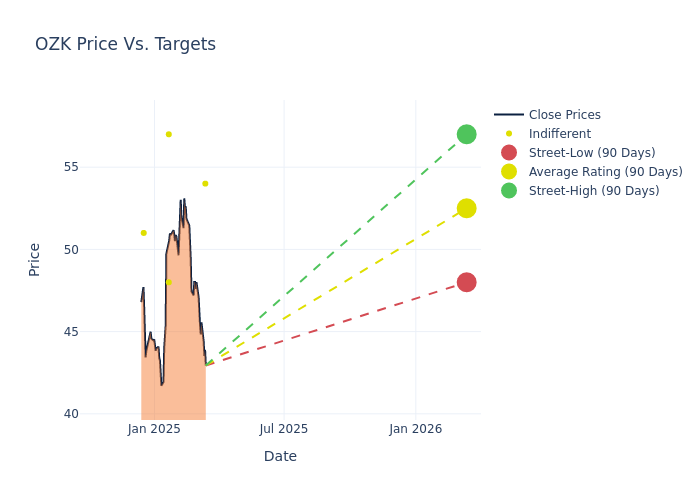

Analysts have recently evaluated Bank OZK and provided 12-month price targets. The average target is $52.6, accompanied by a high estimate of $57.00 and a low estimate of $48.00. Surpassing the previous average price target of $50.40, the current average has increased by 4.37%.

Breaking Down Analyst Ratings: A Detailed Examination

The standing of Bank OZK among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Manan Gosalia | Morgan Stanley | Lowers | Equal-Weight | $54.00 | $58.00 |

| Matt Olney | Stephens & Co. | Raises | Equal-Weight | $57.00 | $53.00 |

| Jared Shaw | Wells Fargo | Raises | Equal-Weight | $48.00 | $40.00 |

| Matt Olney | Stephens & Co. | Maintains | Equal-Weight | $53.00 | $53.00 |

| Nicholas Holowko | UBS | Raises | Neutral | $51.00 | $48.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Bank OZK. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Bank OZK compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of Bank OZK's stock. This examination reveals shifts in analysts' expectations over time.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of Bank OZK's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on Bank OZK analyst ratings.

Get to Know Bank OZK Better

Bank OZK is a bank holding company that owns and operates a community bank, Bank of the Ozarks. The bank operates offices in Arkansas, Georgia, Florida, North Carolina, Texas, California, New York and Mississippi. It provides a range of banking services which include deposit services such as checking, savings, money market, time deposit, and individual retirement accounts to loan services like real estate, consumer, commercial, and industrial loans. Apart from providing traditional banking products and services it also provides treasury management, trust and wealth management, financial planning, online banking, and other related services.

Key Indicators: Bank OZK's Financial Health

Market Capitalization: Indicating a reduced size compared to industry averages, the company's market capitalization poses unique challenges.

Positive Revenue Trend: Examining Bank OZK's financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 1.17% as of 31 December, 2024, showcasing a substantial increase in top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Financials sector.

Net Margin: Bank OZK's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 43.2%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 3.35%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 0.47%, the company showcases effective utilization of assets.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.16.

What Are Analyst Ratings?

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.