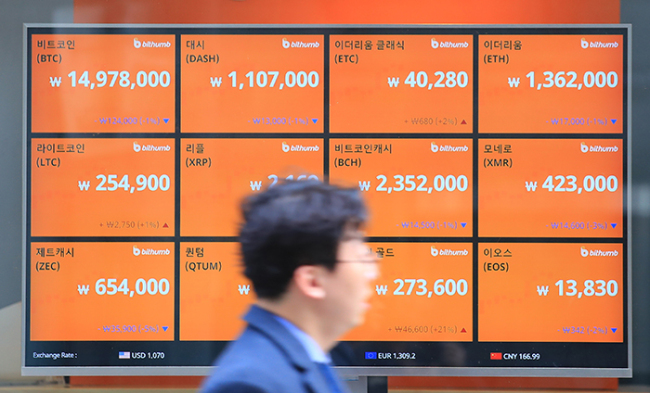

Seoul to require banks to keep record of cryptocurrency transactions

By Bae Hyun-jungPublished : Jan. 21, 2018 - 14:07

The government plans to require banks and exchanges to keep records of cryptocurrency transactions, in a potential move to impose taxes on the largely covert deals, financial authorities said Sunday.

Coming in the wake of the government’s earlier order to convert all cryptocurrency accounts into real-name accounts, the idea reflected Seoul‘s efforts to assume control of the overheated market.

The Korea Financial Intelligence Unit is currently working on a set of anti-money laundering guidelines concerning cryptocurrency transactions, according to the Ministry of Strategy and Finance.

Under the forthcoming rules, cryptocurrency operators will have to exchange users’ transaction data with banks and banks will be obliged to check whether the exchanges comply with the requirement.

Currently, financial regulators ban banks from offering virtual accounts -- needed to sell or buy cryptocurrencies -- to individual customers, as part of its latest measure to prevent speculative investments in virtual coins.

Though this excludes peer-to-peer transactions, the reinforced data regulation is expected to help government officials access core data, especially in cases of suspected money laundering and other irregularities in the largely covert cryptocurrency market.

“Nothing is final as the suggested guidelines are yet under discussion,” the ministry said in a press release, dismissing burgeoning reports that the government may keep surveillance on individuals’ deals.

“There have been no talks whatever on financial authorities looking directly into transactional information.”

Even if implemented right away, however, the data sharing obligation alone may not constitute sufficient grounds for taxation, according to tax officials.

“We will have to make more consultations with the Finance Ministry in order to come up with more detailed taxation plans,” said an official of the National Tax Service.

South Korea, one of the world’s biggest digital currency markets, has recently been struggling to take hold of the unrestrained investments. Extreme measures such as closing down the current operators have been brought up, though the presidential office and financial ministry refrained from the option.

The Financial Services Commission and Financial Supervisory Service are also considering the possibility of revising the Act on Reporting and Using Specified Financial Transaction Information to impose on exchanges the supervisory duty to prevent money laundering.

Meanwhile, the customs office here began to look into possible cases of overseas cryptocurrency speculations.

“We suspect that there have been cases of outbound travelers taking a lump sum on their trip and frequently making speculative purchases,” said an official of the Korea Customs Service. Popular countries were Thailand and Hong Kong, were cryptocurrency tends to be cheaper than in Korea.

The recent increase in the amount of outbound cash is also partly attributable to such speculative acts, the office added.

By Bae Hyun-jung (tellme@heraldcorp.com)

![[Today’s K-pop] BTS pop-up event to come to Seoul](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=644&simg=/content/image/2024/04/17/20240417050734_0.jpg&u=)

![[KH Explains] Hyundai's full hybrid edge to pay off amid slow transition to pure EVs](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=652&simg=/content/image/2024/04/18/20240418050645_0.jpg&u=20240419100350)

![[Today’s K-pop] Zico drops snippet of collaboration with Jennie](http://res.heraldm.com/phpwas/restmb_idxmake.php?idx=642&simg=/content/image/2024/04/18/20240418050702_0.jpg&u=)